Big student loan forgiveness plan announced by Biden

Written by Associated Press on August 24, 2022

WASHINGTON (AP) — President Joe Biden on Wednesday announced his long-awaited plan to deliver on a campaign promise to provide $10,000 in student debt cancellation for millions of Americans — and up to $10,000 more for those with the greatest financial need — along with new measures to lower the burden of repayment for their remaining federal student debt.

FILE – President Joe Biden in the East Room of the White House, Aug. 10, 2022, in Washington. Biden is set to announce $10,000 federal student loan cancellation on Aug. 24, for many, extend repayment pause for others. (AP Photo/Evan Vucci, File)

Borrowers who earn less than $125,000 a year, or families earning less than $250,000, would be eligible for the $10,000 loan forgiveness, Biden announced in a tweet. For recipients of Pell Grants, which are reserved for undergraduates with the most significant financial need, the federal government would cancel up to an additional $10,000 in federal loan debt.

Biden is also extending a pause on federal student loan payments for what he called the “final time” through the end of 2022. He was set to deliver remarks Wednesday afternoon at the White House to unveil his proposal to the public.

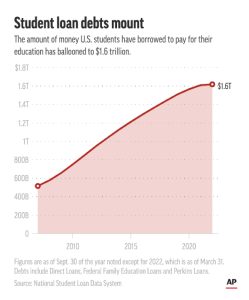

If his plan survives legal challenges that are almost certain to come, it could offer a windfall to a swath of the nation in the run-up to this fall’s midterm elections. More than 43 million people have federal student debt, with an average balance of $37,667, according to federal data. Nearly a third of borrowers owe less than $10,000, and about half owe less than $20,000. The White House estimates that Biden’s announcement would erase the federal student debt of about 20 million people.

Proponents say cancellation will narrow the racial wealth gap — Black students are more likely to borrow federal student loans and at higher amounts than others. Four years after earning bachelor’s degrees, Black borrowers owe an average of nearly $25,000 more than their white peers, according to a Brookings Institution study.

The action drew praise from a wide spectrum of Democrats, but appeared unlikely to completely appease any of the factions that have been jostling for influence as Biden weighs how much to cancel and for whom.

Biden has faced pressure from liberals to provide broader relief to hard-hit borrowers, and from moderates and Republicans questioning the fairness of any widespread forgiveness. The delay in Biden’s decision only heightened the anticipation for what his own aides acknowledge represented a vexing set of political and policy choices. The people spoke on the condition of anonymity to discuss Biden’s intended announcement ahead of time.

The White House emphasized that no one in the top 5% of incomes would see any loan relief.

The continuation of the coronavirus pandemic-era payment freeze comes just days before millions of Americans were set to find out when their next student loan bills will be due. This is the closest the administration has come to hitting the end of the payment freeze extension, with the current pause set to end Aug. 31.

Details of the plan have been kept closely guarded as Biden weighed his options. The administration said Wednesday the Education Department will release information in the coming weeks for eligible borrowers to sign up for debt relief. Cancellation for some would be automatic, if the department has access to to their income information, but others would need to fill out a form.

Current students would only be eligible for relief if their loans were originated before July 1, 2022. Biden is also proposing capping the amount that borrowers must pay monthly on undergraduate loans at 5% of their earnings, down from 10% previously. The Education Department is to post a proposed rule to that effect, which would also cover the unpaid monthly interest for borrowers who remain current with their monthly payments — even when the payments are $0 because their incomes are low.

The Biden administration plan would also raise the income floor for repayments, meaning no one earning below 225% of the federal poverty level would need to make monthly payments.

“The positive impacts of this move will be felt by families across the country, particularly in minority communities, and is the single most effective action that the President can take on his own to help working families and the economy,” said Sen. Elizabeth Warren on Wednesday in a joint statement with Senate Majority Leader Chuck Schumer.

President Joe Biden returns a salute to a Marine Corps honor guard as he walks to board Marine One at Gordons Pond in Rehoboth Beach, Del., Wednesday, Aug. 24, 2022, to travel back to the White House. (AP Photo/Manuel Balce Ceneta)

Tweeted Rep. Pramila Jayapal, the chair of the House Progressive Caucus: “This will bring real relief to 43 million people and is a MASSIVE step in the right direction.”

The Justice Department released a legal opinion on Wednesday concluding that the Higher Education Relief Opportunities for Students Act gives the Education secretary the “authority to reduce or eliminate the obligation to repay the principal balance of federal student loan debt.” The legal opinion also concluded that the debit could be applied on a “class-wide” basis in response to the coronavirus pandemic. Still, some conservative groups were considering potential legal challenges.

During the 2020 presidential campaign, Biden was initially skeptical of student loan debt cancellation as he faced off against more progressive candidates for the Democratic nomination. Sens. Warren, D-Mass., and Bernie Sanders, I-Vt., had proposed cancellations of $50,000 or more.

As he tried to shore up support among younger voters and prepare for a general election battle against President Donald Trump, Biden unveiled his initial proposal for debt cancellation of $10,000 per borrower, with no mention of an income cap.

Biden narrowed his campaign promise in recent months by embracing the income limit as soaring inflation took a political toll and as he aimed to head off political attacks that the cancellation would benefit those with higher take-home pay. But Democrats, from members of congressional leadership to those facing tough reelection bids this November, have pushed the administration to go as broadly as possible on debt relief, seeing it in part as a galvanizing issue, particularly for Black and young voters this fall.

A survey of 18- to 29-year-olds conducted by the Harvard Institute of Politics in March found that 59% of those polled favored debt cancellation of some sort — whether for all borrowers or those most in need — although student loans did not rank high among issues that most concerned people in that age group.

Republicans responded swiftly to Biden’s decision on student debt relief Wednesday, calling out the administration for “selling out working families” to appease to the progressive wing of the party.

“Today’s announcement is an insult to every American who played by the rules and worked hard to responsibly pay off their own debt,” Sen. John Barrasso, chair of the Senate Republican Conference, said in a statement.

Republican Leader Mitch McConnell called the move a “slap in the face,” for working American families.

“President Biden’s inflation is crushing working families, and his answer is to give away even more government money to elites with higher salaries,” McConnell said. “Democrats are literally using working Americans’ money to try to buy themselves some enthusiasm from their political base.”

Biden’s long deliberations have led to grumbling among federal loan servicers, who had been instructed to hold back billing statements while Biden weighed a decision.

Industry groups had complained that the delayed decision left them with just days to notify borrowers, retrain customer service workers and update websites and digital payment systems, said Scott Buchanan, executive director of the Student Loan Servicing Alliance.

It increases the risk that some borrowers will inadvertently be told they need to make payments, he said.

“At this late stage I think that’s the risk we’re running,” he said. “You can’t just turn on a dime with 35 million borrowers who all have different loan types and statuses.”